"Take Control of Your Finances: Simple Steps to Solve Money Problems and Create Wealth!"

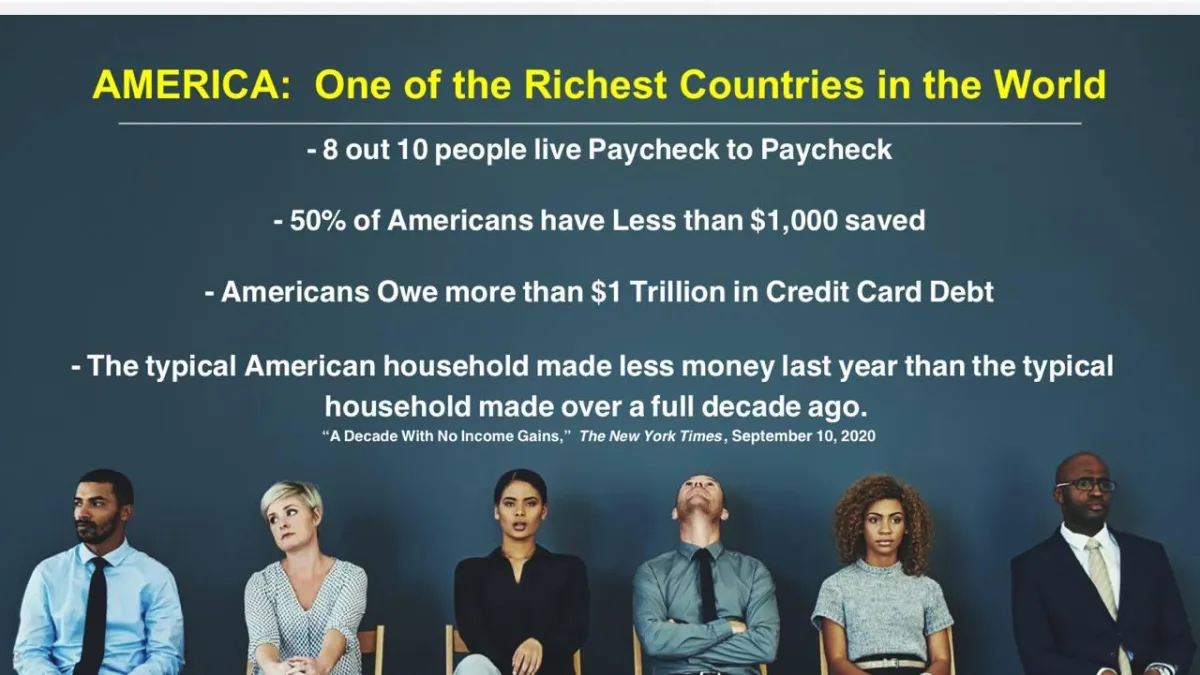

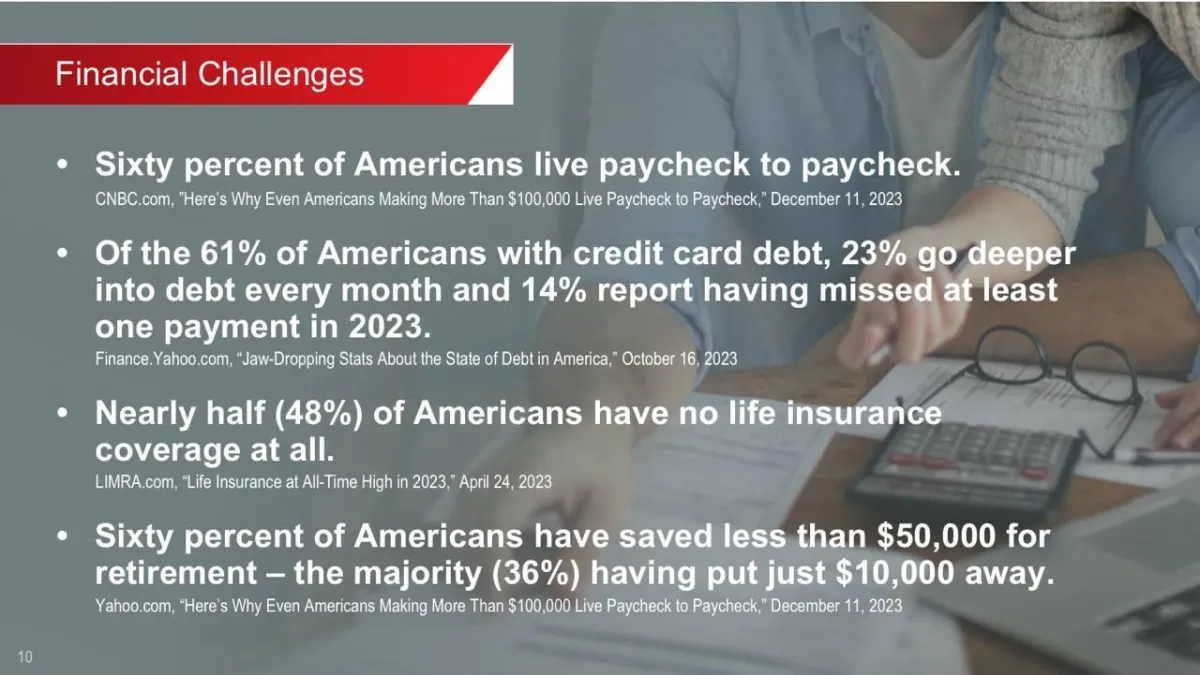

Chances are you can personally relate to some of these financial struggles. If not those certainly some of these below.

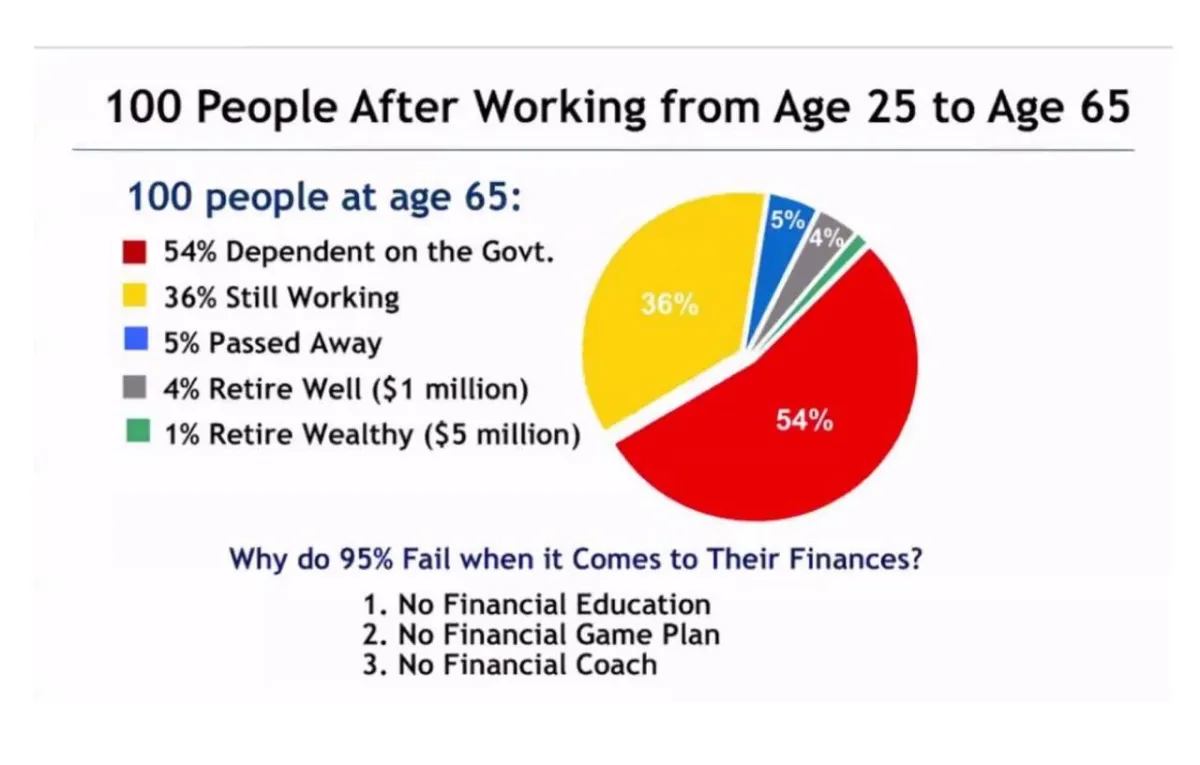

Why are these statistics so important? Because they are a direct reason why we see people struggling to have enough money in retirement.

I know how you are feeling right now. Guilty, confused, mad, like you were taken advantage of. Some of you may even feel like the money game is just not fair. Trust me I get it. I felt the exact same way. Until I realized that Money is a GAME & if I learned the rules to this game, I would be able to win it!

Let's face it they didn't teach us about money in school and most of our parents were just trying to figure it out themselves. So, allow me to teach you the basics. Starting with what all the buzz is about regarding life insurance. Go ahead and press play on the video below.

Okay now that you have learned that you do not need life insurance your whole life what do you need it for? We will use the following example to explain why.

You see why it makes sense to insure yourself with low-cost term life insurance now right?

Let's take the picture below for instance. If two people in the household are paying their bills on two incomes and all of a sudden one income is no longer coming in because of a death.

In the absence of life insurance not only is the family losing a loved one but also their income. Unfortunately, the bills will not stop coming in.

You see life insurance is not to leave a fortune for someone or to get wealthy while you're living. It is purely income protection designed to replace your income for your family in the event of you passing away before your family has become financially independent and wealthy.

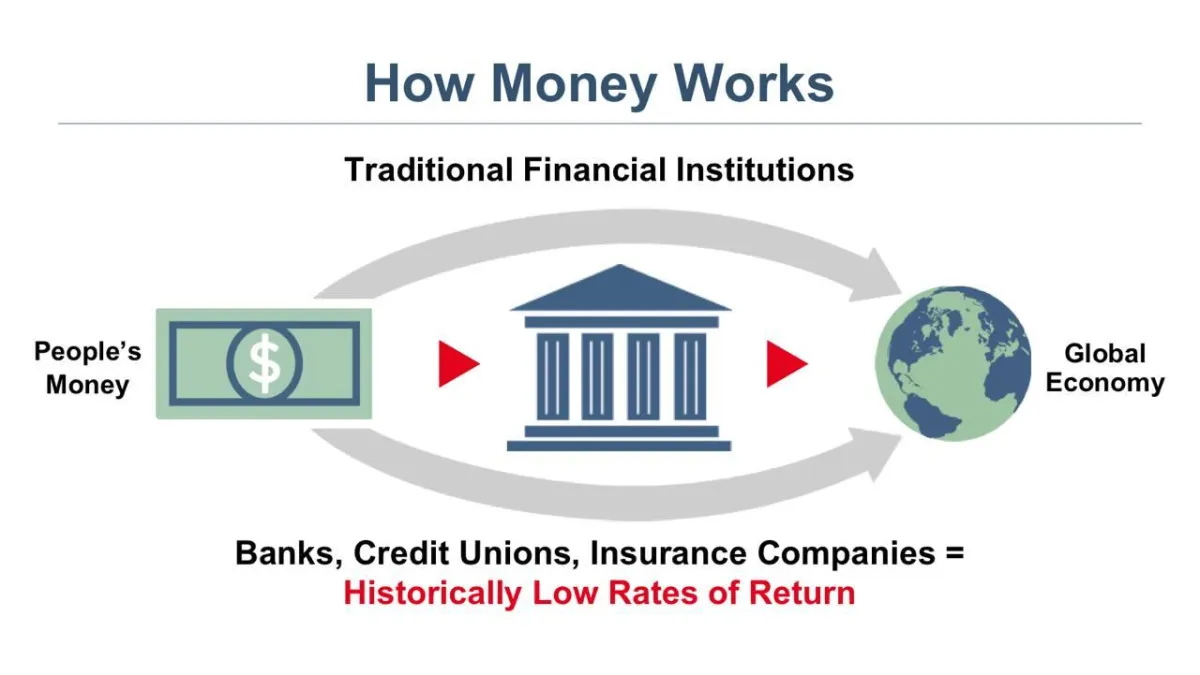

Okay enough about life insurance let's talk about saving and investing money. Most people are doing it all wrong. It starts with what happens when we get paid, and our money is deposited into the bank.

While we are content with it just sitting there in a savings account earning less than 1% annually the bank is using our savings to get rich!

Yes, that's right Rich off of your hard-earned money. They go and invest it into the market and get rates of returns between 9%-12% or they go and lend it out to your neighbor on a credit card at 29.99%.

But what if you could get that 9%-12% a year returns instead of letting the bank get rich using your money?

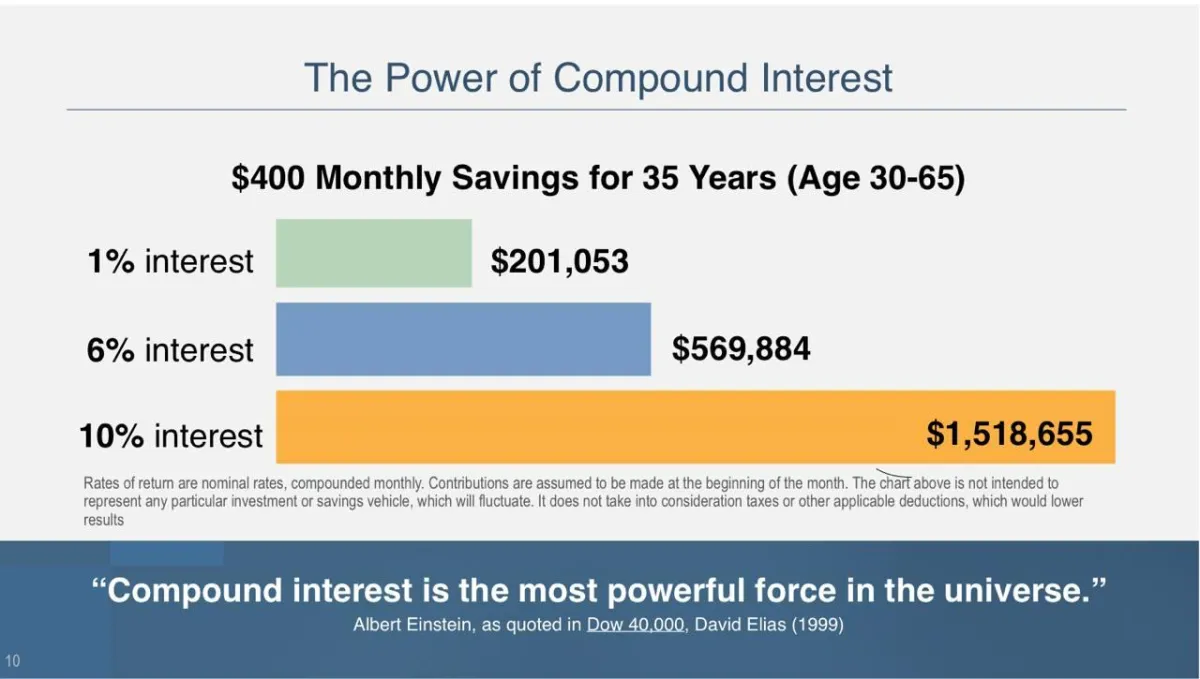

Well, you can, and you should because the difference it can make for you at retirement is astounding.

As you can see the difference is astounding and when you take into account that Americans have trillions of dollars sitting in bank accounts you start to see how many people really do not know what you have learned today.

So, what do I suggest as a plan?

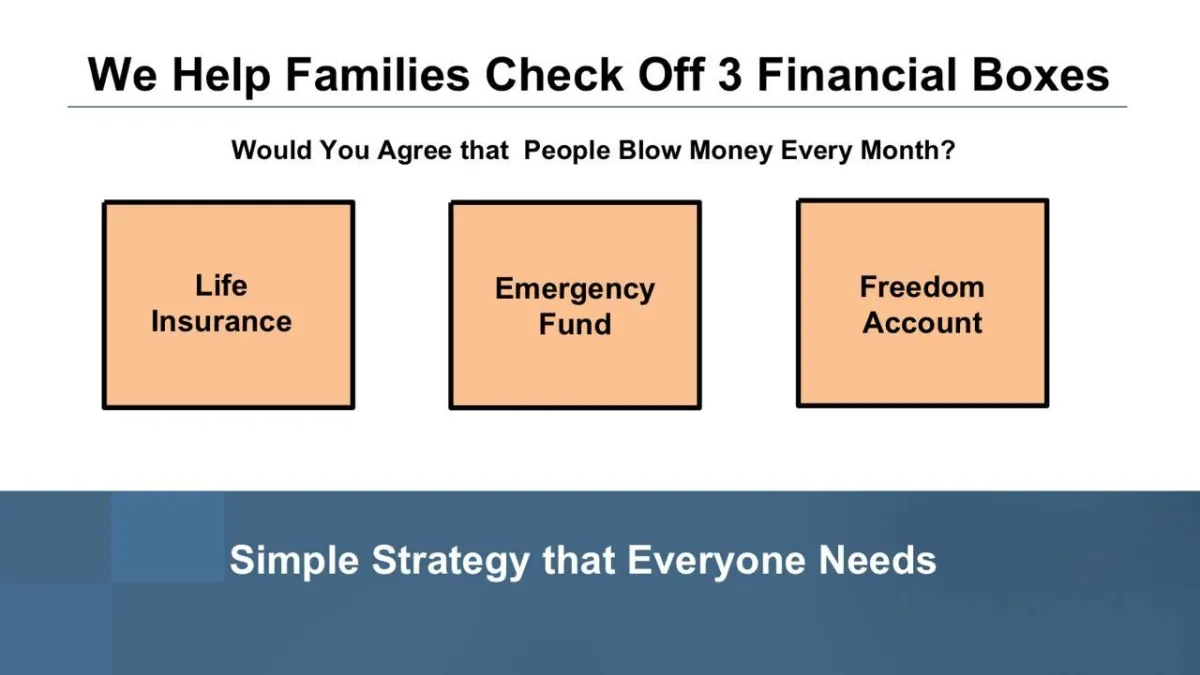

If you just check off these 3 boxes you will be ahead of 90% of the people in the world when it comes to your finances.

Get yourself some low-cost term life insurance, set up an emergency fund of 3-6 months' worth of your expenses and begin investing in a Roth Ira so you can grow your money tax free for retirement.

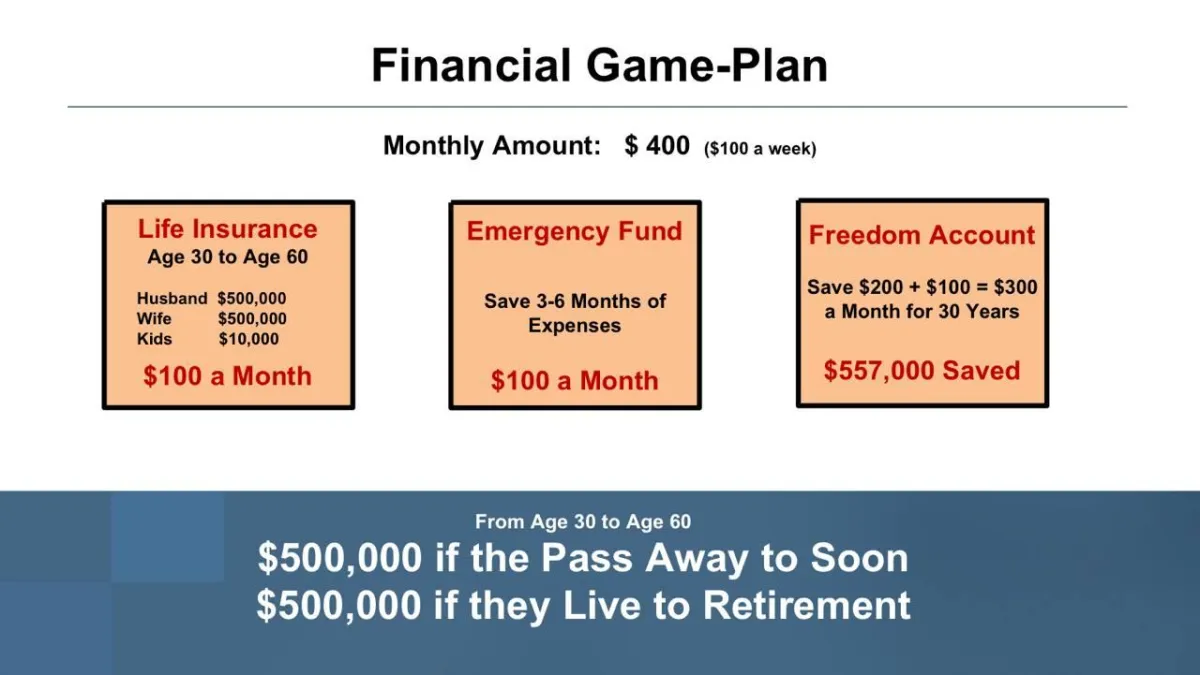

Below is an example of someone who made the choice to do this and here was their outcome.

By setting aside $100 a week that they were already blowing they were able to get their family insured with $500,000 worth of insurance for both parents, $10,000 on their child, start saving money in their emergency fund, and have over $557,000 saved for retirement.

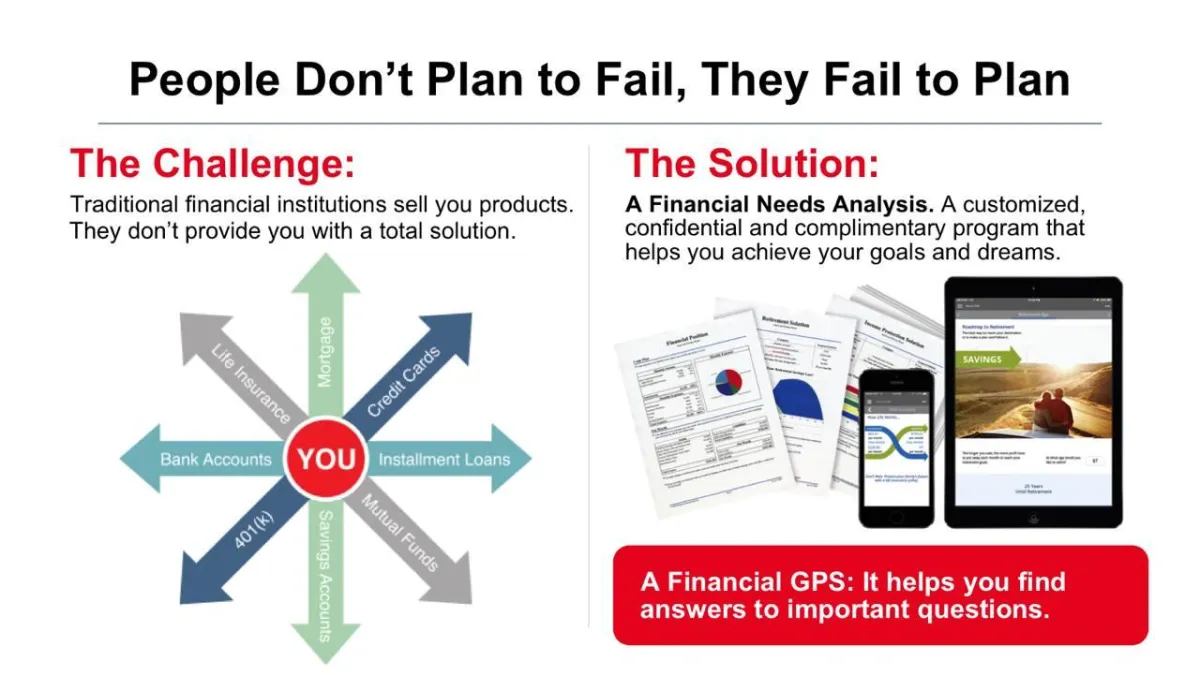

Now look this was a lot of information I know but to recap we said that there are 3 reasons people do not get financially independent.

1. They do not have a financial education

2. They do not have a financial gameplan

3. They do not have a financial professional

My goal today was to provide you with a little bit of the first one and to give you a path to the second and third one.

So, with that being said my name is Shawn Jones and I am a licensed Life insurance agent as well as licensed Investment representative. " They are different so never take investment advice from a life insurance agent."

I would like to offer you a complimentary, customized, and confidential gameplan on how to get out of debt, become properly protected, and financially independent as well as offer my lifetime advisory 100% free of charge.

Take advantage of Shawn's Offer!

Book a Call below

BTW I am expanding my business and looking to open offices around the country teaching these vary concepts. If you are looking for parttime work or possibly a career change let's talk.